China Crayfish Industry Development Report (2022) - 翻译中...

In recent years, China’s crayfish industry has developed vigorously, the breeding area and output have maintained rapid growth, the breeding model has been innovatively developed, rice shrimp farming has changed to the mode of no trenching or less trenching, the scale of the catering market has continued to expand, and the processing and distribution industries , "Crayfish +" cultural tourism industry and other rapidly develop, the whole industry chain and the level of cluster development continue to improve. The crayfish industry has played an important role in ensuring the stable supply of vegetable basket products and promoting fishery efficiency and fishermen' income, and has become an important characteristic industry for promoting rural revitalization and expanding county economy in some regions.

- Industrial scale

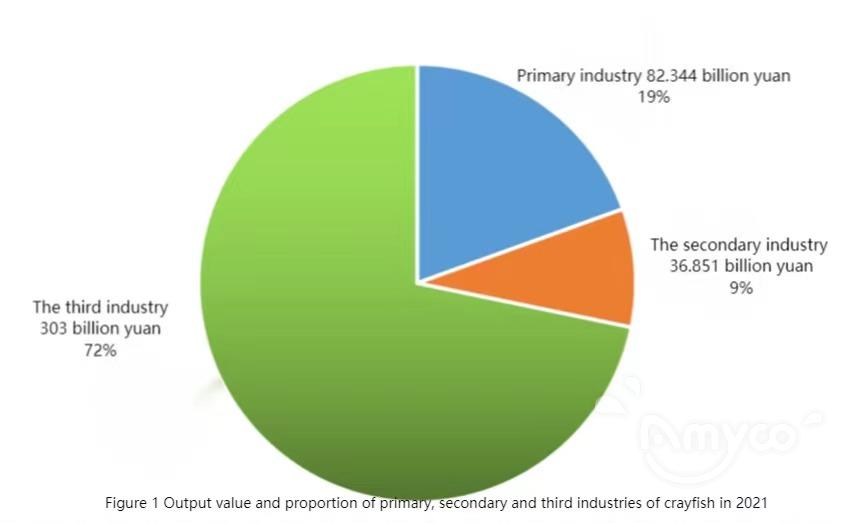

In 2021, although the development of China's crayfish industry will be affected to a certain extent by the COVID epidemic, it will generally achieve steady progress and good growth, achieving restorative growth. According to estimates, the total output value of China's crayfish industry in 2021 is 422.195 billion yuan, a year-on-year increase of 22.43% (the statistics do not include Hong Kong, Macao and Taiwan regions, the same below), and higher than the level in 2019 (the total output value in 2019 is 411 billion yuan). Among them, the output value of crayfish aquaculture was 82.344 billion yuan, a year-on-year increase of 10.03%; the output value of the secondary industry, mainly the processing industry, was 36.851 billion yuan, a year-on-year decrease of 23.24%; the output value of the tertiary industry, mainly catering, was 303 billion yuan, a year-on-year increase. 36.49%. The ratio of primary, secondary and tertiary output value is about 2:1:7 (see Figure 1)

- Aquaculture production

Area and yield

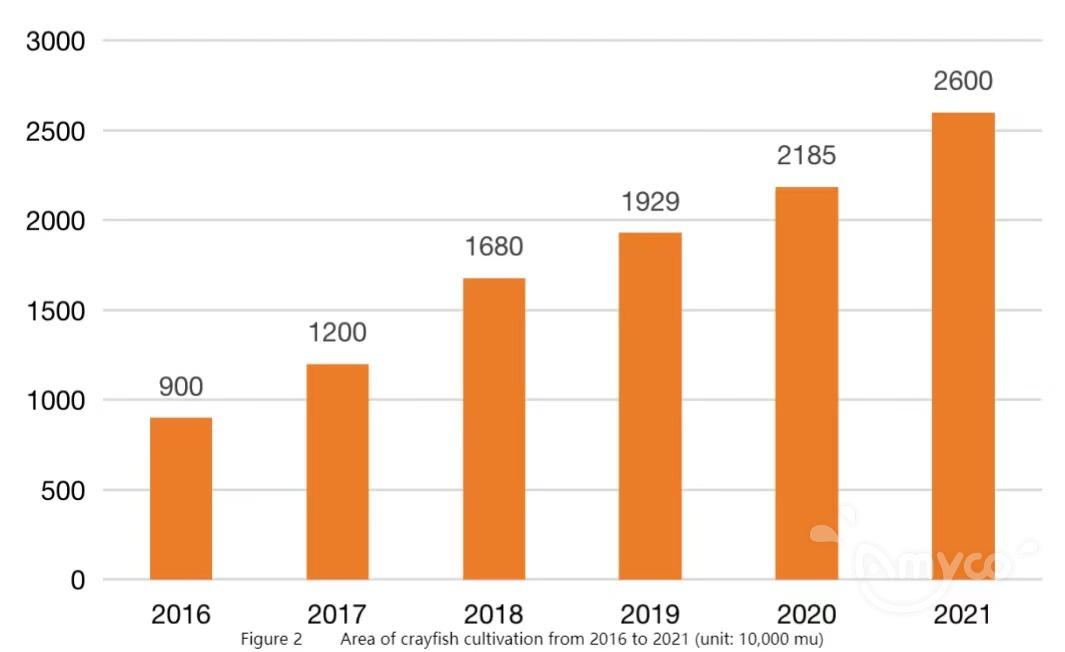

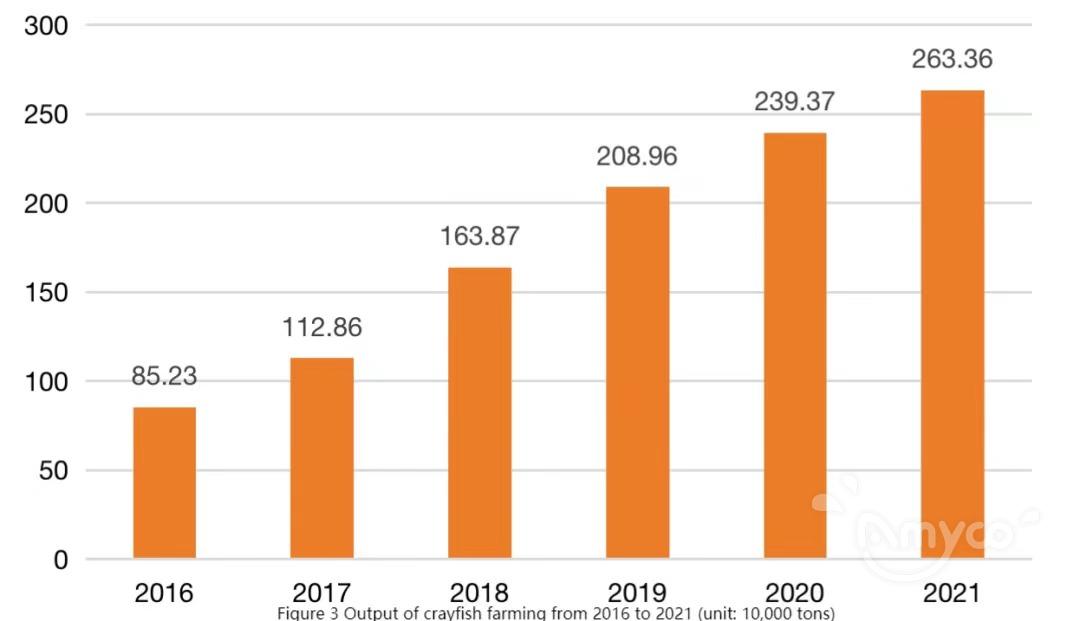

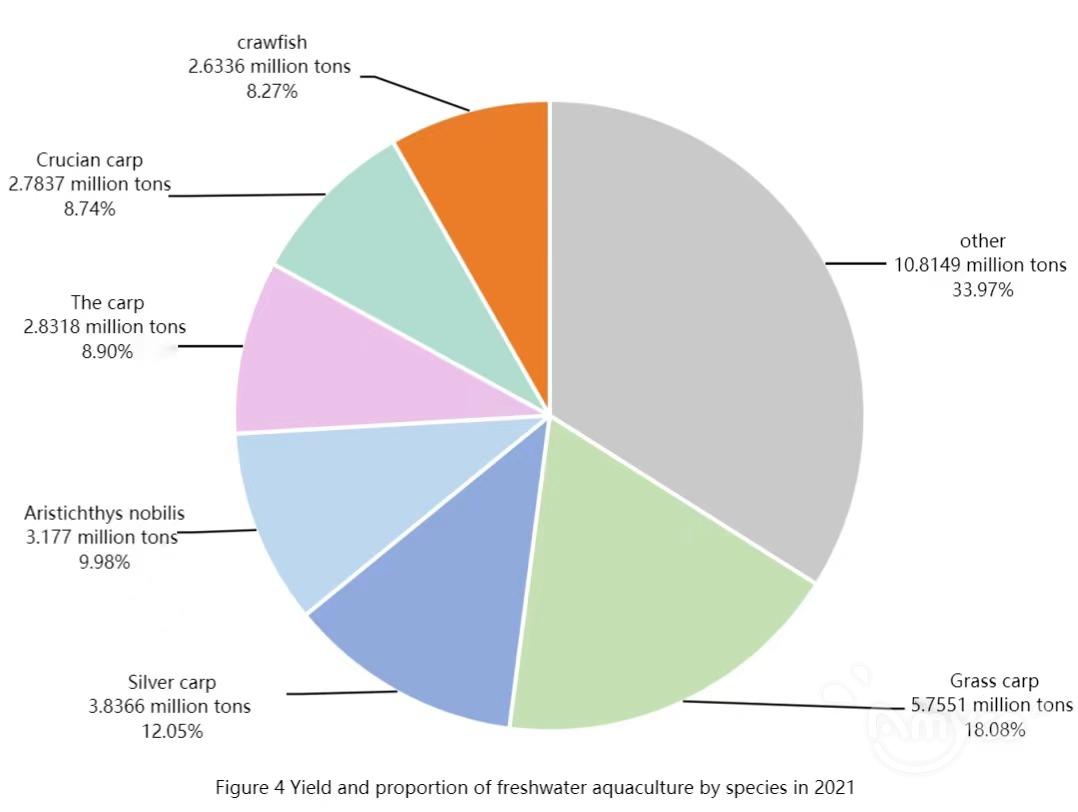

In 2021, China's crayfish farming area of 26 million mu, production 2.6336 million tons, an increase of 19.01% and 10.02% year-on-year respectively, and continue to maintain rapid growth (see Figures 2 and 3). The production of crayfish aquaculture accounts for 8.27% of the total output of freshwater aquaculture in the country, ranking sixth among freshwater aquaculture species in our country (the top 5 are grass carp, silver carp, bighead carp, carp, and crucian carp) (see Figure 4).

Breeding method

Crayfish farming mainly includes rice and shrimp farming, pond farming (including intensive farming, crab pond polyculture), lotus root farming, large water surface aquaculture and other methods, mainly rice and shrimp farming. Among them, the cultivation of rice and shrimp is mainly based on the ring-ditch mode, but in recent years, the mode of no trenching and less trenching has gradually emerged, and it has become an important model for the new development of rice and shrimp cultivation in various places.

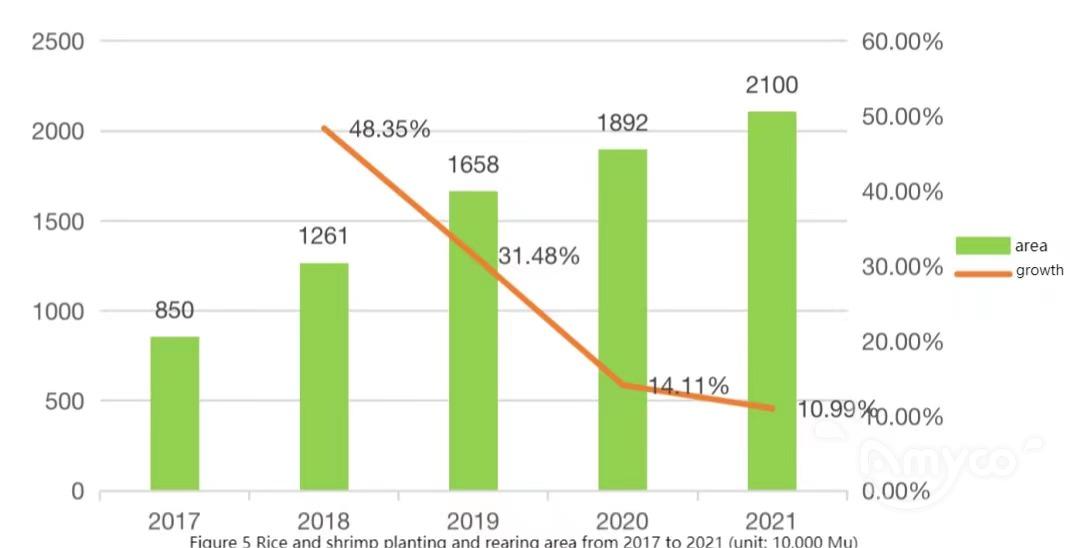

In 2021, the area of rice and shrimp cultivation will be 21 million mu, and the output of crayfish will be 2.2 million tons. The area and output will increase by 10.99% and 6.68% respectively year-on-year, accounting for 80.77% and 83.54% of the area and output of crayfish cultivation. Rice and shrimp farming accounts for 52.95% and 61.85% of the national comprehensive rice and fish farming area and aquatic product output, respectively.

Rice and shrimp farming still maintains rapid development, but with the increase of the base, the development of integrated rice-fishing farming tends to be stable, and the growth rate of rice and shrimp farming slows down (see Figure 5).

Pond culture (including intensive culture, shrimp and crab polyculture), lotus root aquaculture, large-water surface augmentation and other methods of crayfish aquaculture covers an area of 5 million mu, with an output of 433,600 tons, of which pond culture is the main one.

- Crayfish processing

Processing enterprise

In 2021, the processing volume of crayfish will be about 850,000 tons, a slight decrease from 2020. The main reason is that the market price of crayfish in the first half of 2021 is higher than the same period in 2020, and the acquisition of crayfish by processing enterprises is generally delayed. Starting from 2021, the Ministry of Agriculture and Rural Affairs and the Ministry of Finance will jointly implement the fishery development support policy, and list "the initial processing of aquatic products and the construction of refrigeration and preservation facilities and equipment" as the support direction. Promote the construction of crayfish industrial clusters and the development of the entire industry chain. In 2021, the number of crayfish processing enterprises above designated scale will reach 162, with about 30 new ones, and the production capacity will increase significantly. The growth in the number and production capacity of processing companies reflects the industry's long-term optimism about the development of the crayfish processing industry.

From the perspective of regional distribution, crayfish processing enterprises are mainly concentrated in traditional crayfish farming provinces such as Hubei, Jiangsu, Hunan, Anhui, and Jiangxi. Among them, there are more than 80 crayfish processing enterprises above designated size in Hubei Province, 9 crayfish processing enterprises exceeding 10,000 tons, and 5 national-level key leading enterprises in agricultural industrialization, with an annual processing volume exceeding 300,000 tons. In addition, the crayfish processing industry in Jiangsu and Anhui provinces has developed rapidly.

Processed products

Crayfish processing is divided into primary processing and comprehensive utilization of processing by-products, mainly primary processing.

Primary processed products mainly include quick-frozen products (including quick-frozen crawfish tails, quick-frozen crawfish meat, quick-frozen whole crawfish) and ready-to-eat food (including seasoned crayfish, crayfish snack food, etc.). The traditional primary processing of crayfish is mainly quick-frozen products, mainly quick-frozen crayfish tails and quick-frozen crayfish, and the ratio of the two is about 2:1. In recent years, the proportion of quick-frozen products has gradually decreased, and the proportion of ready-to-eat foods has increased. Among the ready-to-eat foods, pre-crayfish dishes have become a new favorite in the market, and the demand for seasoned crayfish with shelled shrimp tails and seasoned whole shrimp has increased significantly. Pre-prepared aquatic products in China are in the "blue ocean market". The application scenarios of pre-crayfish dishes are rich and the development space is huge.

The comprehensive utilization of crayfish processing by-products maintains a good development trend. By-products such as crayfish heads and crayfish shells from crayfish processing account for more than 70% of the raw materials, and can extract oils, functional peptides, astaxanthin, chitin, chitosan and other substances, which can be widely used in food, medicine, health care, etc. There is huge potential for comprehensive utilization. At present, such processing enterprises are mainly concentrated in Hubei Province, represented by Huashan Technology Co., Ltd. The processed products mainly include chitin derivatives such as chitin and glucosamine hydrochloride, and the annual processing of waste crayfish shells is 100,000 tons. Other major farming provinces are gradually involved in the comprehensive utilization of crayfish processing and by-products. In 2021, a number of intensive processing production lines will be added. Typical enterprises include Shunxiang Food Co., Ltd. in Hunan Province and Jiujiang Kairui Ecological Agriculture Development Co., Ltd. in Jiangxi Province.

- Consumption and trade

Price trend

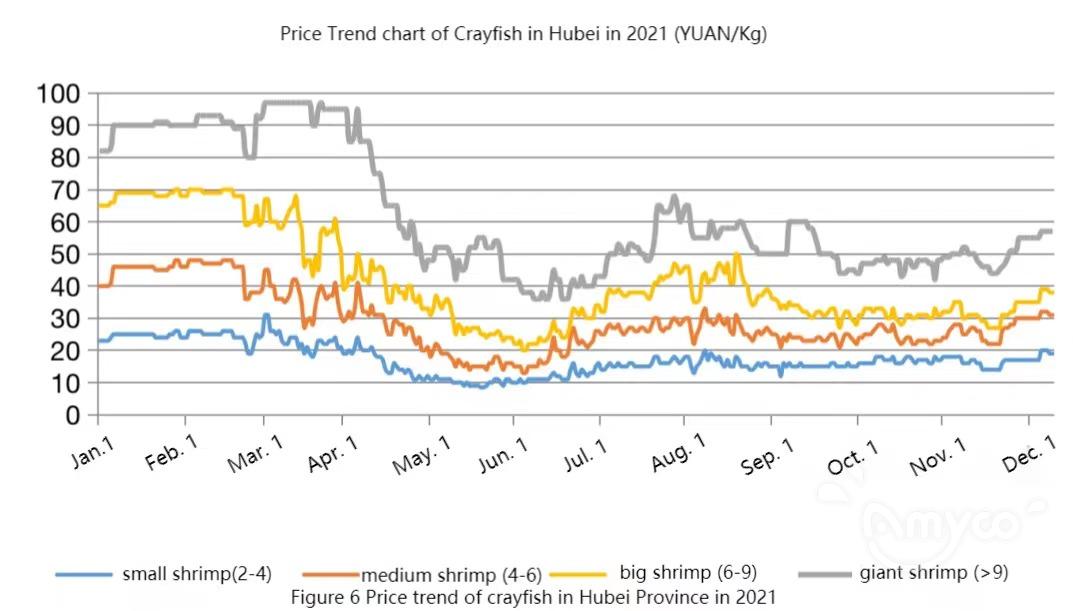

In 2022, the price of crayfish will stabilize and rebound, and the prices of different sizes of crayfish have risen, but the market is clearly differentiated. Urgent market demand for the shift to "big size crayfish". Taking Hubei Province as an example (see Figure 6), during the peak period of the market for crayfish, the price of crayfish below 4 mace is about 6-10 yuan/kg, the price of 4-6 mace crayfish is about 20 yuan/kg, the price of 6-9 mace crayfish is about 35-40 yuan/kg, and the price of crayfish above 9 mace is higher than 70 yuan/kg.

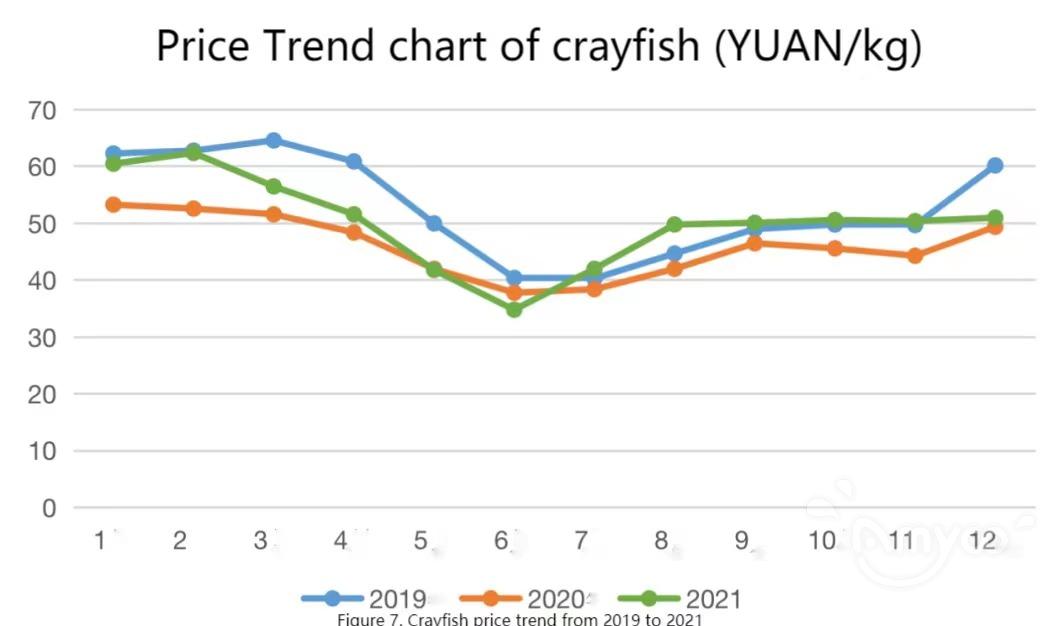

The price of crayfish has obvious cyclical characteristics (see Figure 7), and the trend is still U-shaped throughout the year. From January to March and October to December, the price of crayfish in the traditional production off-season is higher, and the price of crayfish in the concentrated market period from May to June is higher than that in the off-season Low, with prices at their lowest point in late May to early June.

The price of crayfish has obvious cyclical characteristics (see Figure 7), and the trend is still U-shaped throughout the year. From January to March and October to December, the price of crayfish in the traditional production off-season is higher, and the price of crayfish in the concentrated market period from May to June is higher than that in the off-season Low, with prices at their lowest point in late May to early June.

Food consumption

In recent years, crayfish catering consumption has continued to boom, driving the booming development of the crayfish industry. After the outbreak of the COVID in 2020, the catering industry was greatly impacted, the offline consumption of crayfish was weak, and the online consumption increased significantly. In 2022, offline consumption of crayfish will basically recover, and online consumption will continue to maintain rapid growth.

The offline stores have obvious characteristics, including crayfish-themed chain restaurants, restaurants with crayfish as their main summer dishes, cheap restaurants and food stalls with crayfish as their signature dishes. In some places, by establishing a crayfish catering street and a food city, creating a crayfish food cultural landmark, driving offline consumption, and promoting the development of catering enterprises. In 2021, there are nearly 20,000 crayfish catering brick-and-mortar stores in Hubei Province, with an output value of about 54 billion yuan. There are more than 4,600 crayfish catering brick-and-mortar stores in Jiangxi Province, and more than 600 were added in 2021. The huge offline consumption market has spawned a number of well-known crayfish catering brands. Well-known catering brands in the main producing areas include Shrimp King, Bali Lobster, Liangliang Steamed Shrimp in Hubei Province, Wenheyou and Youjian Shrimp Shop in Hunan Province; Well-known catering brands in major consuming cities include Shanghai Red Armor and Hu Xiaopang, Shenzhen Songge Braised Prawns and Fallen Crayfish, Chengdu King Prawns, and Beijing Hu Da Restaurant.

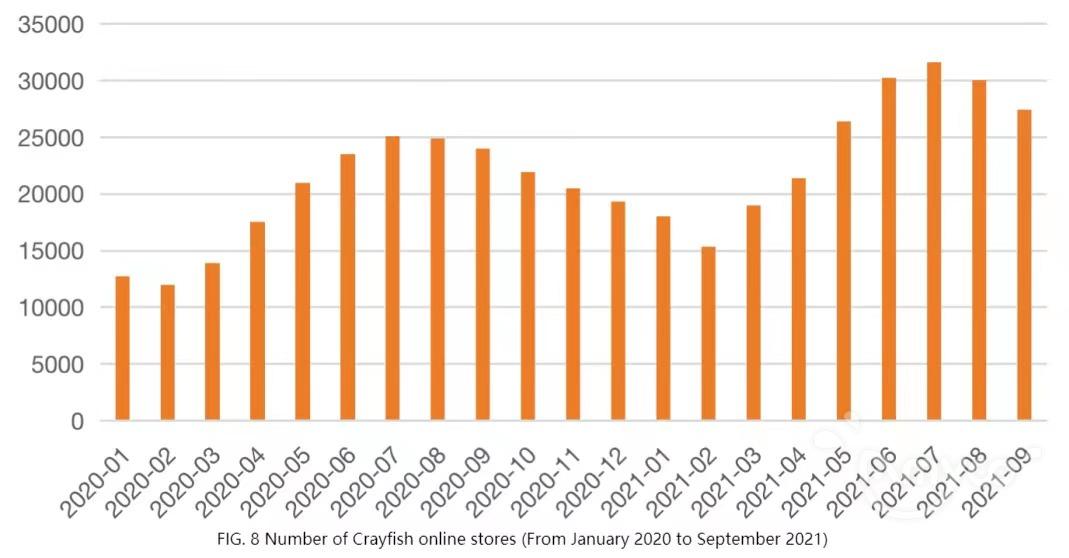

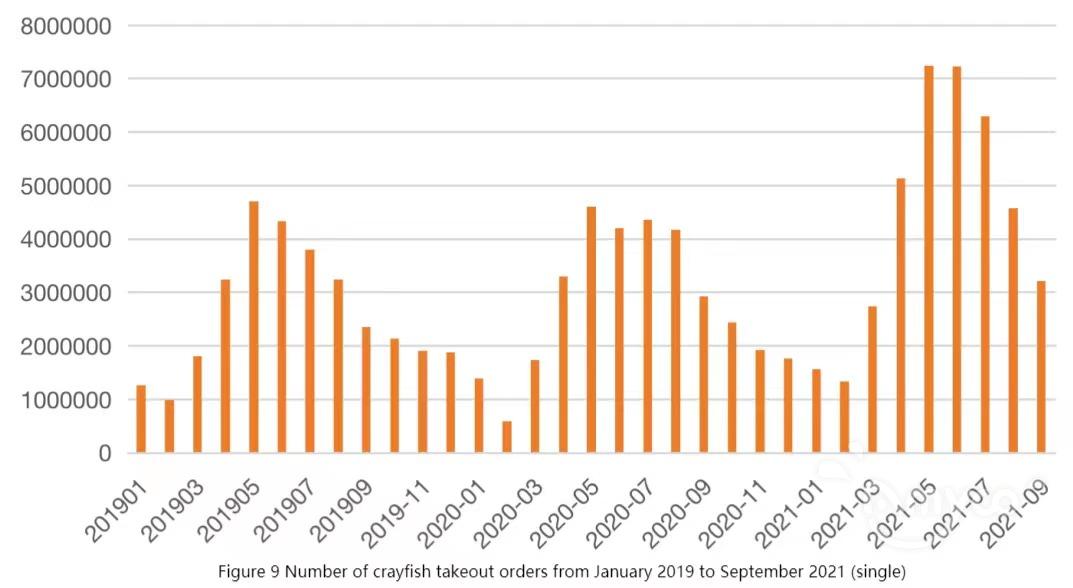

The online penetration rate of crayfish has increased year by year, and takeaway has become an important channel for crayfish catering consumption. According to relevant data from Meituan, from January to September 2021, the number of online crayfish stores and takeaway orders are both higher than those in the same period in 2020 (see Figures 8 and 9). The cycle of online consumption of crayfish is consistent with that of crayfish production. January-February and September-December are low seasons. Starting from March, online consumption has shown explosive growth, peaking in May-June, and then declining. April-August is the peak season for crayfish consumption.

The variety of seasoned crayfish products, the expansion of application scenarios and the improvement of market share, as well as the continuous development of the logistics and transportation system, have provided strong support for the long-term and stable development of online crayfish consumption. For example, Xuyi County, Jiangsu Province has set up a central kitchen of Xuyi Lobster in target cities such as Shanghai, signed a strategic cooperation agreement with Meituan Takeaway, etc., and established a 30-minute delivery circle, which has effectively promoted the instant consumption of crayfish.

Import and export trade

According to relevant customs statistics, China's international trade of crayfish increased in 2021. The annual export volume of crayfish is 9863.46 tons, a year-on-year increase of 27.42%, and the export value is 119.4313 million US dollars, a year-on-year increase of 57.93%; the import volume of crayfish is 5435.28 tons, a year-on-year increase of 44.48%. %, the import value of crayfish was 106.4146 million US dollars, a year-on-year increase of 80.05%.